For an efficient GTM, targeting the right persona is not enough - you must also narrow your lead funnel

Startups don’t fail because they picked the wrong persona; they fail because they spend time on the wrong moments and the wrong accounts

Once your personas are defined, the next GTM unlock is ruthless funnel narrowing: prioritizing the small slice of accounts that are in-market now, reachable through trust-rich paths, and engaged with intent signals you can act on quickly.

Success comes from focusing your outreach where fit × intent × timing × trust are strongest.

1) From personas to ICPs — and why narrowing matters

Personas describe who you speak to inside a company; an Ideal Customer Profile (ICP) describes which companies you should speak to in the first place (industry, size, tech stack, geography, etc.). In B2B, both are complementary: ICPs drive account selection and prioritization; personas drive messaging and conversation design.

Critically, large deals are rarely decided by one person. Gartner finds typical buying groups of 6–10 decision makers, each armed with independent research — which is precisely why funnel narrowing and multi-threading matter more than ever.

But in this context, the key thing to remember is that only a small share of your ICP is “in-market” at any given time. Leading ABM/intent platforms estimate ~5–10% of ICP accounts are actively buying right now, making prioritization essential to GTM efficiency.

2) The four components of effective funnel narrowing

To turn your ICP into revenue quickly, operationalize these four components:

Speed — connect fast when signals spike. (Modern buyers spend limited time with vendors; delays matter.)

Fit — pursue accounts that match your ICP and personas tightly.

Trust — leverage warm paths (referrals, mutual connections) to boost attention and reply rates.

Timing (Intent) — act when accounts show buying signals (topic research, review site activity, repeated visits).

3) Tactics that actually narrow the funnel (and why they work)

A) Activate your (extended) network to create trust-rich entry points

Warm pathways beat cold outreach on both speed and conversion.

After years in the field, I’m still struck by how much faster deals close when there’s an existing connection or a trusted referral compared to a pure cold approach — inbound or outbound — even when the value proposition is a perfect fit.

Activating your network may only cover the first three components of funnel narrowing, but the speed and ease of those connections make it indispensable.

LinkedIn recommends leading with common connections — which can raise appointment likelihood by ~70% — and turning cold calls into “warm calls” through social insights. Benchmarks on LinkedIn/omnichannel outreach also show higher DM reply rates than cold email when you “warm” prospects first (engage their posts, reference mutual context, etc.).

Vendor studies vary, but multiple analyses report warm outreach yielding 2×–4× reply rates versus cold — a pragmatic reason to mine alumni, ex-clients, partners, and 2nd-degree connections systematically.

How to operationalize : make a habit of the 30-second “elevator pitch” everywhere with your ex-colleagues, friends or relatives — including old contacts you haven’t spoken to in 15 years, map mutuals via TeamLink and ask for intros. One of them might become your next reference customer.

B) Use intent data to find the 5–10% who are in-market now

Modern ABM platforms (Demandbase, 6sense, Bombora) aggregate first-, second- and third-party signals to reveal which accounts are researching your category, comparing vendors, or spiking on relevant keywords. That enables you to prioritize outreach based on timing, not just fit — and to tailor your messaging to the buyer’s journey stage, fully aligning with the fourth component: Timing and Intent.

Published case evidence and platform studies show intent-driven GTM can shorten cycles and improve conversion by engaging accounts already mid-journey (e.g., “Consideration”/“Decision”).

C) Run targeted outbound email — with realistic benchmarks

Cold email still works, but only with tight ICP filters, clean lists, and useful offers. 2025 benchmarks typically show 1–5% reply rates on cold email (top performers hit 8–12% by narrowing lists and personalizing), while multi-channel sequences outperform email alone. Plan volumes accordingly and score responses fast.

Analyses across millions of emails report average replies in the ~5% range, with personalization and careful follow-ups lifting results. Keep expectations grounded; focus on quality, intent and fit.

D) Events with the right audience are still pipeline engines

In-person events/trade shows remain strong lead channels when your audience is specific and your follow-up is disciplined. Industry stats highlight exhibitors’ focus on lead quality and decision-maker engagement, and event ROI practices emphasize tracking pipeline and velocity, not just badge scans.

Plan KPIs around qualified leads, stage movement, and post-show meetings — not just footfall or swag. [nparallel.com]

E) LinkedIn Groups and Sales Navigator — use with care

Groups can be helpful for warm outreach: join relevant groups, engage authentically, and reference the group in your connection request. If you export member data with third-party tools, mind legal/TOS boundaries: scraping publicly available data can be lawful in some jurisdictions, but LinkedIn’s terms restrict automation and you risk account action if you overstep. Proceed responsibly.

Sales Navigator itself offers powerful lists, shared lists, and “buyer intent” style recommendations — but there are limits (e.g., interface constraints, view caps) and no native “competitor followers list.” Build precise ICP searches and use Shared Lists to collaborate, rather than chasing hacks that violate TOS.

4) A practical FIT × INTENT × TRUST × SPEED playbook (you can implement tomorrow)

Decide your ICP and buying committee: Define the firmographic filters and 2–3 core personas you’ll engage per account (e.g., CMO + CIO + Procurement) to multi-thread from the start.

Stand up a simple lead scoring model: Combine fit (ICP match), behavioral intent (web/review/keyword signals), and engagement (opens, replies, meetings). ML-based scoring can outperform manual rules when data volume grows.

Route by trust first: Prioritize outreach paths with mutual connections/referrals; treat “warm” lanes as SLA-driven (same-day outreach).

Trigger sequences on intent spikes: When an account hits a threshold (e.g., multiple visits to pricing/integration pages, review site comparisons), launch a tailored cadence referencing the signal.

Instrument events for pipeline, not just leads: Track stage-movement, meeting set rates, and post-event conversion — then feed all contacts back into your scoring model.

Measure what matters: Focus on cost per qualified lead (CPL), opportunity conversion rate, pipeline velocity, and win rate by source. Use these to re-weight your scoring and channel mix quarterly.

5) What this means for founders and GTM leaders

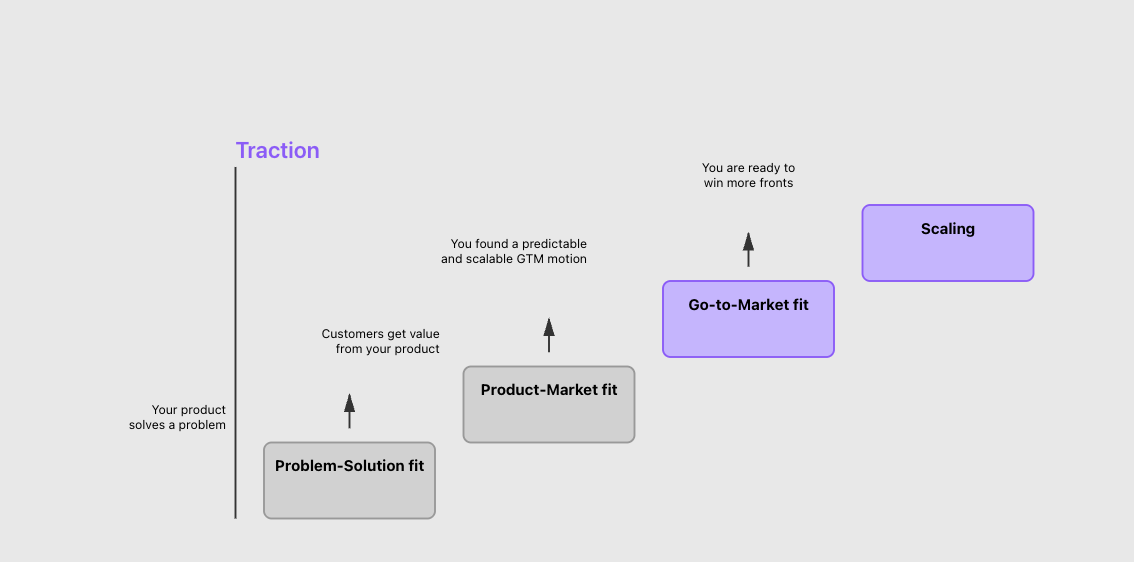

In your first 12–24 months to a post-PMF business, resist the urge to “spray and pray.”

Direct 60–70% of your selling time to warm paths + intent-qualified accounts; keep cold outbound limited to tightly curated micro-lists. Expect that, at any given time, most of your ICP is not buying — and design your operations to identify and move on the few who are.

As your data grows, consider augmenting manual scoring with predictive models to prioritize leads more accurately and reduce CAC. Pair this with a strict, shared SLA across marketing and sales to touch intent spikes within hours, not days.

Narrowing the funnel is your unfair advantage

Targeting the right persona is table stakes; narrowing the funnel is where efficiency — and early revenue — happens. Build a GTM engine that:

Finds in-market accounts (intent),

Filters ruthlessly by ICP fit,

Flows through trusted pathways first, and

Fires with speed when signals appear.

Do this consistently and you’ll compress sales cycles, lift conversion rates, and build repeatable pipeline without ballooning spend — because you’re investing where timing and trust converge, not where interest is merely hypothetical.

References (curated)

Personas vs ICPs — definitions & use cases:

LakeB2B: ICP vs Buyer Persona · ExpertBeacon: ICPs vs Buyer PersonasBuying committees & journey:

Gartner: New B2B Buying Journey (6–10 decision makers; limited vendor time) · Madison Logic: Rise of the Buying CommitteeIn-market share & intent data:

6sense: Only 5–10% of ICP buying now; journey stage insights · Demandbase: What is ABM Intent Data + use cases · Bombora: Harnessing Intent Data for ABM · ZenABM: Intent-based ABM tools & 5% TAM in market · Zavops: ABM tools & cycle reductionWarm vs cold outreach benchmarks:

LinkedIn Sales Solutions: Warm calls & common connections (+70% appointment likelihood) · Expandi: State of LinkedIn Outreach 2025 · LeadCRM: Warm vs Cold Outreach · LinkedFusion: Warm vs Cold reply ratesCold email benchmarks:

Martal Group: 2025 B2B cold email stats (1–5% replies; multi-channel lifts) · Belkins: 16.5M emails analysis (reply ~5.8%) · Aerosend: 2025 reply rates (1–5% healthy) · BuiltForB2B: Top campaigns 8–12% repliesEvents & ROI:

Cvent: Trade show statistics (lead quality, decision-maker engagement) · Bizzabo: Measuring trade show ROI for pipeline · nParallel: KPIs for trade show effectivenessLinkedIn Groups & scraping/legal:

PhantomBuster: Is LinkedIn scraping legal? (hiQ context & TOS cautions) · Lobstr.io: Legal overview & best practices · PhantomBuster workflow: Group members to outreachSales Navigator features & limits:

LinkedIn Help: Sales Navigator Lists, Shared Lists, recommendations · Outbound System: Practical SN limits & search hygieneLead scoring models:

LeadOps: Building fit+intent scoring that works · Frontiers in AI (2025): ML lead scoring outperforms rules-based