Beyond vibes: Rules of Growth for AI-Era Startups (2/6)

Six questions to get your startup idea from Zero → Momentum on a minimum viable budget ($2,000+)

I’m Kate, Fractional CMO for edtech startups, and whenever I begin a role, I use these six questions to challenge myself and the teams I’m supporting. They are a compilation of the best lessons I’ve learned from my mentors and hands-on experience

Big reveal Number #2:

2. If we reverse-engineer from (i) revenue goal to (ii) reach required, what would the funnel be?

Growing an audience of customers isn’t vibes, it’s math.

Too many founders set “grow fast” as their goal, without any knowledge of the obstacles they might face and the time required to overcome them.

We are not going to aim for the moon without building a rocket.

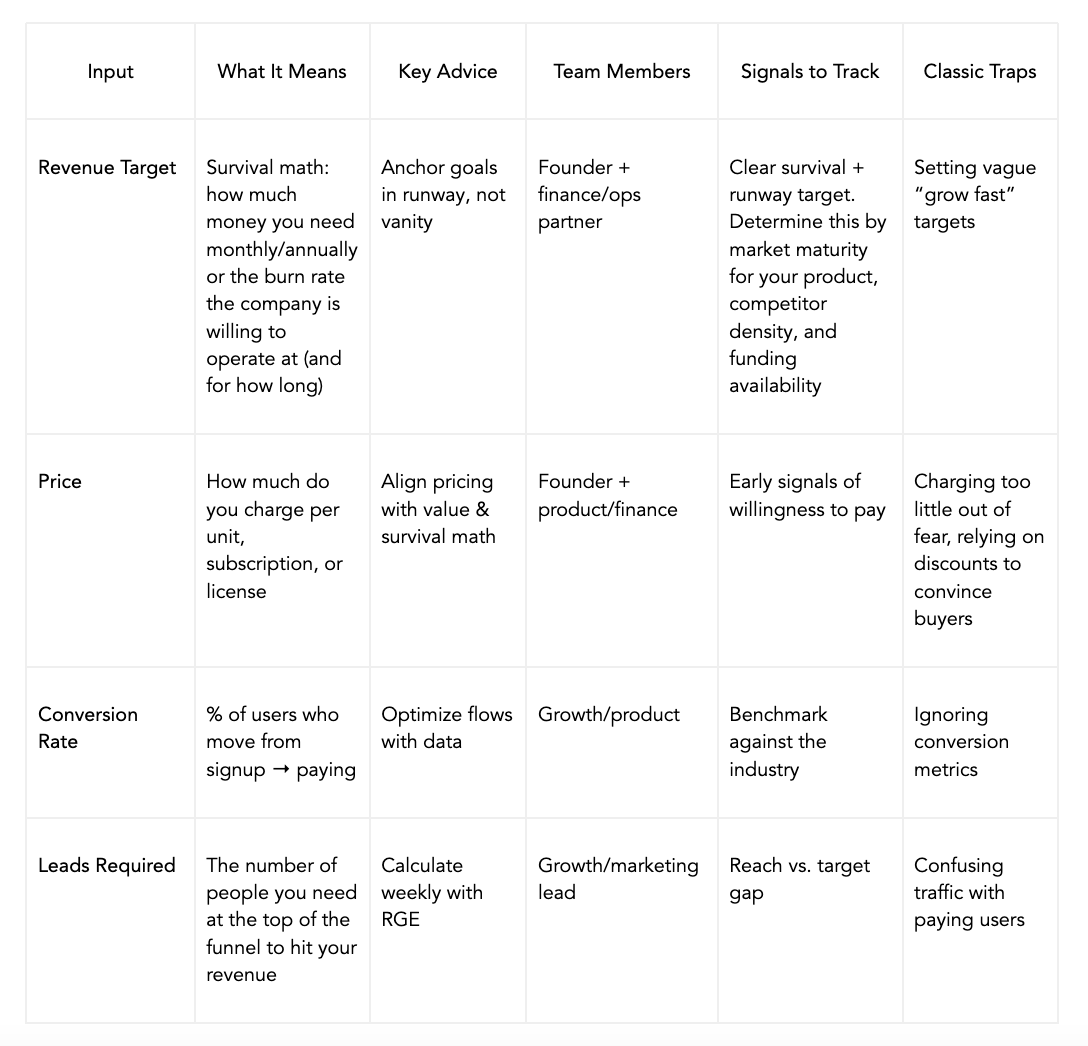

Let’s work backward from your revenue goal to understand the inputs required. This is the only equation you need:

The Reverse Growth Equation (RGE)

Let’s break this down:

Lots of theory here, so let’s apply it to your business.

Actionable Playbook (Do This Week)

Set your survival goal

Example: $10k new MRR per month in 6 months. (Focus on growth per month, not total revenue.)Translate goal into leads (simplified)

Using RGE:

Leads needed per month = New MRR target / (Avg revenue per customer × Conversion rate)

Example: $10k ÷ $50 ÷ 0.05 = 4,000 leads/month.

⚠️ Note: This is a simplification. Realistically, your MRR compounds over time as cohorts retain revenue. For precise total MRR projections, a spreadsheet model can help account for retention and cohort growth.

Audit your current reach

Check signups, demos, calls—where are you now versus your target?Identify the gap

How many additional leads or conversions do you need to hit your growth goal?Run 3 quick experiments

Focus on the biggest levers that can close the gap. Track results and iterate quickly

Pro Tip: Get ideas for experiments using the prompt below.

Steal this prompt (and get a prompting masterclass here)

Act as a senior growth and funnel strategist for early-stage startups.

My goal is to reach [revenue target, e.g., $10,000 MRR] in [time frame, e.g., 6 months].

My product/service is priced at [price per unit or subscription], and our current conversion rate is [current conversion %].

Please provide:

Lead/Signup Requirements: calculate the number of leads or signups needed per month to reach the revenue goal.

Estimated Marketing Budget: approximate spend needed for an unknown brand to achieve sufficient category reach.

Funnel Bottlenecks: identify the most critical points in our current funnel limiting growth.

Scrappy Experiments: suggest 3 low-cost, high-impact experiments to improve performance.

For each recommendation, include:

- Key assumptions

- Expected effort, cost, potential impact

- Any creative or unconventional tactics that could stretch budget efficiency.

Also, suggest any overlooked opportunities or alternative approaches to accelerate revenue growth.These companies already figured it out:

B2B case study

When Jasper launched its AI copywriting platform, the founders didn’t just chase hype: they worked backward from their first-year revenue target. Their math: $1M ARR in year one. At $99/mo pricing, they needed ~850 paying users. With an average free-to-paid conversion rate of ~5%, they reverse-engineered a requirement of ~17,000 trial signups. Instead of blowing money on ads, they focused on:

Partnering with influencers and affiliate marketers in copywriting and marketing circles

Building a free Facebook community that funneled warm leads

Optimizing onboarding flows so new users generated first outputs in minutes

By tracking signups vs. required volume weekly, they spotted gaps early. The discipline worked, Jasper hit $40M ARR within two years. Their RGE discipline helped them scale responsibly, ensuring every channel was tied back to funnel math.

Lesson: B2B founders can’t rely on vibes, they need growth rooted in unit economics and funnel math. “Spend and see” isn’t a strategy; it’s a gamble that ends in luck or a crash. Jasper’s discipline in tracking conversion rates and lead requirements gave them a repeatable, defensible path to scale, and a blueprint worth emulating.

B2C case study

Stardust Analytics (2025) is a small Shopify-focused analytics tool that was vibe coded on Lovable. The startup recently raised about €1.7M (pre-seed) after winning a Lovable contest and demonstrating early product interest. Investors were attracted by fast build cycles, clear ROI for Shopify merchants, early traction/pilots and strong maker/community visibility.

So how’d they get their initial traction?

Stardust reverse-engineered their targets by treating a narrow set of Shopify merchants as the product, mapping each store’s purchase funnel, isolating the single KPI that most constrained growth (traffic→conversion, checkout dropoff, average order value, etc.), and instrumenting quick experiments and diagnostics to prove lift; built in seven months on Lovable, they launched fast into the Lovable maker community and a Lovable contest to get beta testers, ran founder-led paid pilots with 10–50 stores to collect ROI case studies, optimized onboarding via a Shopify app listing and step-by-step diagnostic flows, and grew by publishing concrete case studies, forging small agency/integration partnerships, and using referral and maker-channel virality to keep CAC low, iterating off pilot feedback until conversion economics looked repeatable, which then convinced early investors to write the pre-seed check.

Lesson: Beginning with the revenue goal allowed Stardust to design messaging experiments, persona targeting, and product nudges that directly drove conversions.

B2B Metrics & Growth Tips

Factor in longer sales cycles and multiple touchpoints

B2B deals often take months or even years to close, with multiple decision-makers involved.

Early-stage founders or new product teams should map the buyer journey to understand where touchpoints occur (emails, demos, calls, content) and plan for incremental engagement at each stage.

Consider LTV/CAC per account and pipeline velocity

LTV (Lifetime Value) estimates the total revenue you can expect from a customer over the life of their relationship with your product. For new products, LTV may be uncertain because churn rates aren’t established yet—start with assumptions and refine over time.

CAC (Customer Acquisition Cost) includes sales and marketing expenses directly tied to acquiring a customer, but be mindful: not all expenses count (exclude unrelated overhead, but include outbound campaigns, sales salaries, tools, and content creation).

Pipeline velocity measures how quickly opportunities move from lead to closed-won. Track it to forecast revenue and identify bottlenecks.

Model pricing scenarios for enterprise contracts, tiers, and discounts

Enterprise deals often include negotiations, volume discounts, and custom contracts.

Simulate different pricing models to understand revenue impact, margin sensitivity, and potential churn risk.

Caveat: For brand-new products, treat all metrics as provisional. The goal is to build a repeatable framework, not perfectly predict outcomes from day one.

B2C Metrics & Growth Tips

Think high-volume, low-ticket economics

B2C growth often depends on reaching many users with low-cost offerings (subscriptions, in-app purchases, small physical products).

Focus on unit economics: what margin per user is sustainable given acquisition costs?

Map conversion rates across funnels

Track every step of the user journey, from signup to onboarding to free-to-paid upgrades.

Even small percentage improvements at each stage can compound significantly across thousands of users.

Incorporate viral loops and referral multipliers

Many B2C products grow faster when users invite others or trigger network effects. Example: Keila Shaheen’s story of how a TikTok influencer review sparked 1 million sales of her “The Shadow Work Journal” in under a year.

Factor the potential impact of referrals into acquisition forecasts—e.g., each new user might bring in 0.2–0.5 additional users on average.

Caveat: For new products, historical churn and engagement rates won’t exist. Start with educated assumptions, track data closely, and iterate quickly.

Word to the wise: the answers to question 2 and question 3 go hand in hand.

Don’t bring your reverse-engineered revenue plan to the table until you’ve completed question 3, which covers product-market fit.

And without product–market fit, even the best revenue plan won’t save you.

More from “Rules of Growth”

Read it now:

1. Where are we in the growth journey today?

3. If we work forward from (i) customer insights to (ii) revenue goal, what are we required to do?

Coming soon:

4. How can we make our $1 budget work like $10?

5. What scrappy growth moves feel authentic to our company?

6. Let’s zoom in and execute: who is our beachhead persona and our wedge?

Kate Busby is CoFounder of Quiet Edge and a Fractional CMO based in Barcelona, Spain, catch her on X and Instagram. The images are extracted from X and created by MidJourney. No names and identifying details have been changed. Subscribe to Substack to receive all articles in the “Rules of Growth” series straight to your inbox.

🤝 Want to work together? ⏩ Check out the options and let me know how we can join forces.